Motorcycle insurance rates are subject to a variety of different variables and are calculated using sophisticated algorithms. However, there are several factors that we know can impact the price that you pay.

Read on to learn more about these factors and how you can make adjustments to find an insurance premium that works best for you.

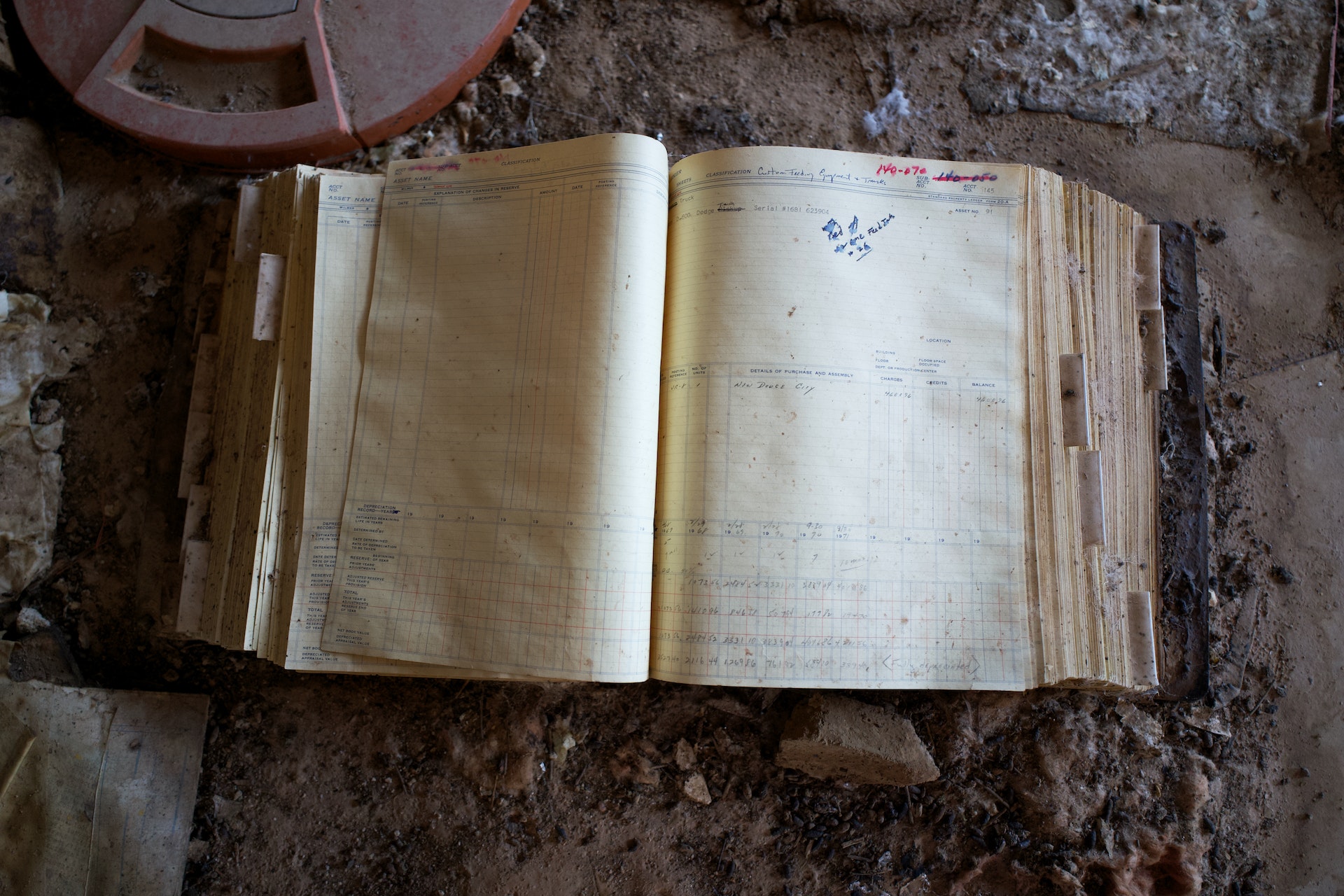

Make and Model

Via Damon Motorcycles

Like any other vehicle on the road, insurance companies look at make and model as part of determining the overall premium. If you’re keen to ride a sportbike because cruisers are boring to you, insurance also expects sportbike riders to ride faster. Naturally, this means higher risk of injury or death especially amongst supersport bike riders at nearly 4 times the average compared to other motorcycle types like cruisers and touring.

So if you’ve been eyeing that Ducati Panigale V4S as your first bike, know that you’ll be slotted in with a high-risk group and your premium will reflect as such.

Bike Value

Via webBikeWorld

This leads to the next point: how much does your bike cost?

More bike = more expensive.

If you get into an accident or repairs are required because you did a lowside crash, you’re looking at a new set of fairings and a new kickstand at best. Motorcycles that cost more to repair command a higher rate to insure them if you have comprehensive and collision insurance.

A set of fairings for a Kawasaki Ninja might cost around $500 USD but the same set for a BMW S1000RR will put you above $1000 USD easily.

Age

Via Pexels / Cotton Bro

Not only are motorcycle riders at significantly higher risk of dying in accidents compared to car drivers, we know that younger riders will engage in riskier activities as well. This includes stunting, riding past speed limits, ignoring the rules of the road, the list goes on.

As a result, insurance companies are keenly aware of the risky behaviour younger riders take with them on the road.

It is usually expected that with more experience comes lower rates and on average, 18 year-old riders can expect to pay way more out of pocket than say a 40 year old rider.

It’s part of the reason why car rental companies do not favour young drivers and tend to charge less once they are 25 years of age or older.

Driving and Riding History

Via Pexels / Strange Happenings

Much like any motor vehicle insurance plan, driving history tells a huge part of the story in terms of your risk and liability for the insurance company.

Accruing demerits and speeding tickets over time essentially tell companies that you’re not a reliable or safe motorist on the roads. At-fault claims and convictions on your record will heavily affect your rate as drivers with bad records tend to repeat these same mistakes.

While you can’t control for a factor such as your age, just bear in mind that when you compound a pattern of poor driving with the fact that a motorcycle is already high-risk, it doesn’t make a case for cheaper premiums.

Type of Coverage

Via Pexels / Mikhail Nilov

Choosing the proper type of coverage is important. If you live in Canada where winters are long, you’re likely to store your motorcycle for several months at a time.

Obviously, if you’re not riding the bike or if you don’t ride daily, your rate can be impacted due to the frequency of use and how far you ride.

Comprehensive coverage will cover your ass (figuratively and literally) in the event that you crash and need significant repairs, but if you’re one to squeeze out every dollar of savings, then having third-party coverage only will also lower your premium. However, it’s not recommended as full coverage not only covers both parties but can also protect you in case of theft and vandalism.

You’d hate to wake up just to find that someone has pushed over your bike for no reason at all. It happens.

Tips on Lowering Insurance Cost

So you’ve called up your insurance company but they won’t budge on their rate and nothing seems to be lining up. What else can you do?

Buy Less Bike

For obvious reasons, if you’re choosing a flashy 2-wheeler for a first bike, you might want to rethink this. We’re not saying you need to go and buy a scooter, not that there’s anything wrong when a BMW CE04 can still top out at 120km / 75mph.

However, you might just want to start off with a smaller displacement bike or consider a standard before you go HAM on a sport or supersport motorcycle. A Kawasaki Ninja 400 or Honda CBR600 are perfectly suitable for first time riders and aren’t prohibitively expensive unless you miss all the marks on the factors above.

Motorcycle Courses

Via Pexels / Griffin Wooldridge

Taking a motorcycle training course such as Gear Up can reduce your insurance rate. Make sure you check in with your provider to see if they’ll accept it. The savings to be had might not pay for the price of the course itself, but it’s a set of valuable skills that you’ll carry for the rest of your riding life.

Shop Around

If your current provider won’t budge, and you’re wondering how much you’ll pay yearly, you can get a quote comparison between motorcycle insurance providers before finalizing your policy. Find something that works for your wallet and lifestyle. There’s a lot of different options out there so don’t feel like you’re tied to a particular plan.

Clean Up Your Act

Sometimes you just have to accept the bitter truth. You’ve been driving like a hoonigan for years and your bad habits have caught up with you. If you want a bike now, you’ll have to pay to play or spend some time cleaning up your act.

Get rid of your demerits and establish a pattern of responsibility and safety, and hopefully, you’ll work your way back into the good grace of an insurance company that won’t completely bend you over on your yearly rate.

Last but not least, and we can’t believe that this even needs to be said, for the love of god don’t ride without insurance. Your safety matters as well as every other motorist on the road.

Stay safe on the twisties.